Join Over 16,000 Families

Who've Had Up To

100% Of Nursing Home

And Other Long-Term Care Expenses Covered By The Government

...While Protecting Nearly $2 Billion In Assets

The Nation's Most Experienced Experts In Nursing Home Medicaid Application Processing.

16,000+

Families Helped

28+

Years of Experience

Nearly

$2 Billion

in Assets Protected

Our experience was outstanding.

I am so glad I contacted Platinum. From my initial conversations with Ashley to working with Jenna, Platinum was there every step of the way. If you follow their directions and get them the information needed, you will have a reason to celebrate!

April O

They achieved achieving outcomes that I would not have been able to on my own.

Platinum Benefits helped to secure Longterm Care Medicaid benefits for my mother and her boyfriend. They are a great team to work with and very quick to respond and answered all questions...Thank you!!

Vincent M

Truly a 5 STAR Company! Highly recommend!

Glad we were told about Platinum Benefit Service! Tonya assured us our loved one would be approved, and just got word she was! Thank you to everyone at Platinum for being so kind and helpful throughout this process!

Ome L

Navigating the complex process of applying for long-term care benefits can feel overwhelming,

but Platinum Benefit Services, Inc. is here to make it so much easier.

Since 1996, we’ve helped over 16,000 families secure Medicaid benefits while simplifying the process and offering peace of mind.

With our expertise in home health, assisted living, and nursing home Medicaid applications and asset protection strategies, we've worked alongside legal counsel to safeguard Nearly $2 billion in assets.

Whether it’s a straightforward case or an ultra complex application, Platinum Benefit Services specializes in removing the stress from the process so families can focus on what matters most - caring for loved ones.

Why Not Just Hire A Lawyer?

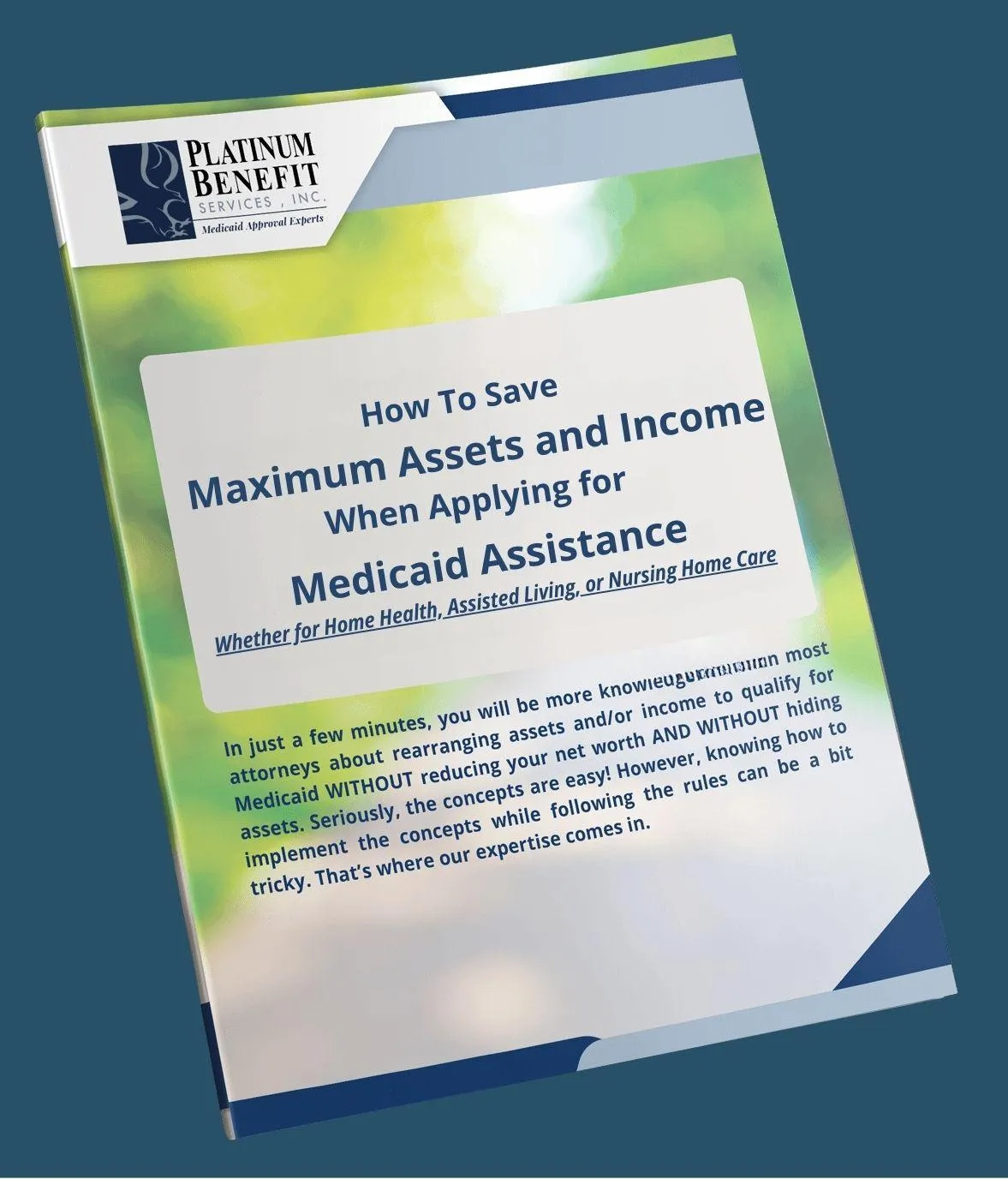

If you’ve thought about hiring only a lawyer to apply for Medicaid benefits, consider the following:

Florida has over 100,000 attorneys, many of whom have added elder law to their areas of practice. However, only a handful of them are true experts in Medicaid planning and the application process.

Even board-certified Elder Law Attorneys often lack the hands-on experience needed for a high-end, comprehensive Medicaid plan and application (think book smart versus street smart).

With that said, legal guidance in Medicaid planning is essential, as it involves real estate, tax, investment, insurance, probate, and estate law.

Navigating the process without legal advice or using a non-legal Medicaid application service without proper legal counsel could be financially costly and could be a violation of state law for the non-attorney planner.

While attorneys should handle legal advice and documents approval, it’s often best to leave asset repositioning and application filing to highly specialized professionals.

This is where Platinum Benefit Services comes in.

Platinum partners with attorneys to streamline and simplify the process, saving you money while removing stress and overwhelm. We will recommend several skilled and experienced attorneys that understand advanced Medicaid planning and are well versed in our systems and technology, allowing Platinum and the attorney of your choosing to work together seamlessly on securing the best outcome for you or your loved one.

9

Reasons

You Should Rely On Platinum Benefit Services, Inc. AND An Elder Law Attorney’s Medicaid Planning Assistance.

1

You will benefit from an attorney's legal expertise,

while also leveraging our nearly three decades of experience with Medicaid application prep and processing. You get the best of two unique levels of expertise.

2

Platinum provides white glove service.

This includes, but is not limited to the initial conversation, information gathering (we write and call companies for you), helping you understand the various steps, providing ongoing support during the plan implementation process, weekly updates during the application process, conducting annual reviews on your behalf after your correct approval, and so much more. Attorneys simply are not set up to provide this level of service.

3

You and your attorney will benefit from Platinum's deep bank of knowledge.

We have knowledge and experience regarding advanced protections strategies that are virtually impossible to find anywhere else. These strategies can make even complex and high net worth cases a smooth process for protecting assets, income, and even insurance proceeds. Because we've successfully processed over 16,000 cases, we've seen and executed on almost every conceivable asset protection plan.

4

With Platinum you receive a 100% money back guarantee.

If we fail to provide the service and results we promise, then we refund your fee and still complete the case. Most attorneys cannot provide this type of guarantee.

5

Platinum will help your attorney understand how to accomplish THREE HIGHLY DESIRABLE OUTCOMES:

1) maintain control of assets within the family

2) maintain liquidity

3) legally avoid tax consequences

Many attorneys don't have the experience in more sophisticated strategies to accomplish all three highly desirable outcomes.

6

Platinum will obtain a little known benefit called UMED (Unreimbursed Medical Expense Deduction)

to recover money you may have already spent on long-term care prior to applying for Medicaid. This typically ranges from a few thousand to many thousands of additional dollars saved. Most attorneys don't know about this benefit, don't know how to calculate it, and don't know how to apply for it.

7

Platinum will communicate at least weekly with you and your provider regarding the progress of your Medicaid case and expected benefit timing and amounts.

Many clients and providers get frustrated with attorneys for lack of communication. Communication is at the core of our process.

8

Platinum provides a knowledge bank of videos to help you understand concepts that apply to your case.

While we are always happy to explain, we find that visuals increase the ability to more rapidly understand the concepts at hand. Most attorneys haven't taken the time to create these support aids, which often leaves the client feeling uninformed.

9

Most attorneys require you to do all of the paper chasing. At Platinum you have a team of people that do everything they can for you.

We only ask for your help when other methods of obtaining information fail. Even then, we are typically on the phone with you to obtain needed verifications and other documents. You will not feel alone in the process when you choose Platinum.

Platinum will help your family maintain control of assets and income, maintain cash liquidity, and minimize or completely eliminate tax consequences all while providing your family a Platinum level of service!

WELCOME TO