***CREDIBILITY BAR***

AS FEATURED IN:

To qualify for the Veteran’s Aid and Attendance benefit application you must meet the following major criteria:

1) Be a United States veteran who served at least 90 days on active duty with at least one day being during a period considered wartime by the Veteran’s Administration, or be the spouse or surviving spouse of such a veteran.

2) Be other than dishonorably discharged.

3) Must be 65+ years old

4) Must need assistance with two of the five following activities of daily living (ADL):

Eating

Bathing/Showering

Dressing

Using the toilet (continence), and

Transferring (mobility as in transferring from a chair to standing)

Be aware that there are also instrumental activities of daily living (IADL) that do not carry as much weight as the ADLs but can help push a borderline case in favor of the veteran. The IADLS are

Shopping

Food Preparation

Housekeeping

Laundry

Medication Handling

Telephone Usage

Transportation (ex. getting to doctor's appointments)

5) Meet financial criteria which include both assets and income (assets can generally be worked around)

6) The Veteran’s Aid and Attendance benefit application, in very general terms, is calculated as follows: Total Income minus total medical cost equals a given amount. If the total medical cost reduces income to an amount below the potential benefit amount, then the VA will pay to bring the veteran’s remaining income up to the potential benefit amount, but not to exceed the maximum benefit for that veteran or spouse’s status.

Example (Married Veteran) - Maximum Benefit = $2,742

| Income | $ 3,000 |

| Medical Expense (assisted living cost) | ($3,000) |

| Remaining Income | ($ 0 ) |

| The Veteran would qualify for the full amount | $2,642 |

However, if the assisted living benefits for veteran's cost was only $2,000 then the veteran would be left with $1,000 of his/her income and the benefit would be capped at $1,727. Max benefit equals $2,727 - $1,000 remaining income equals $1,727.

The actual calculation is a little more complex, and the numbers work out a little differently than explained above, but for understanding the concept, the above conveys the message.

Example (Married Veteran) - Maximum Benefit = $2,742

| Surviving Spouse | $1,432 Monthly / $17,184 per year |

| Single Veteran | $2,229 Monthly / $26,748 per year |

| Married Veteran | $2,642 Monthly / $31,704 per year |

| Two Vets Married | $3,536 Monthly / $42,432 per year |

Veteran’s Aid and Attendance Benefit Wartime Dates

Mexican Border period

(May 9, 1916, to April 5, 1917, for Veterans who served in Mexico, on its borders, or in adjacent waters)

World War I

(April 6, 1917, to November 11, 1918)

World War II

(December 7, 1941, to December 31, 1946)

Korean conflict

(June 27, 1950, to January 31, 1955)

Vietnam War era

(November 1, 1955, to May 7, 1975, for Veterans who served in the Republic of Vietnam during that period. August 5, 1964, to May 7, 1975, for Veterans who served outside the Republic of Vietnam.)

Gulf War

(August 2, 1990, through a future date to be set by law or presidential proclamation)

If you believe you may qualify for this Aid and Attendance benefit, please call and we will discuss your options.

If you don’t believe you qualify, call anyway. With proper guidance, virtually anyone can qualify for Medicaid benefits, regardless of assets or income.

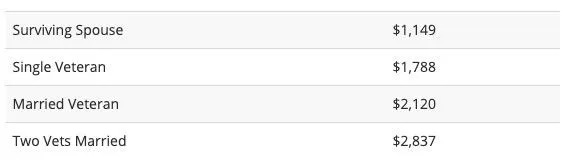

Veterans who served at least 90 days that included at least one day during wartime and were other than dishonorably discharged, may qualify for Pension / Aid and Attendance. This benefit provides $90 per month as a personal allowance which is not paid to the nursing home. More substantial benefits are available for home health care (including payment to family caregivers) and assisted living benefits for Veterans up to the following amounts which are completely tax free:

Be aware that dramatic changes in benefit qualification criteria in the Veteran's Aid & Attendance program are underway. It is critical that the information used in evaluating eligibility is current. The information on this site is believed to be current as of January 1st, 2024. Changes in the program are certain. It is crucial that you are aware of any changes before filing an application. We are happy to provide assistance at your request.

Anyone giving advice regarding veteran's benefits must be an Accredited VA Representative. This requirement is true for both attorneys and non-attorneys alike.

No firm, whether attorney or non-attorney, can legally charge for filing an initial application for veteran's benefits. If a veteran has been denied, appeals and reapplications may be at a cost to the veteran.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean in urna tristique, dictum mauris eget, elementum massa. Suspendisse imperdiet finibus diam, at molestie est venenatis sit amet.

Clients Name

TITLE, COMPANY OR LOCATION GOES HERE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean in urna tristique, dictum mauris eget, elementum massa. Suspendisse imperdiet finibus diam, at molestie est venenatis sit amet.

Clients Name

TITLE, COMPANY OR LOCATION GOES HERE

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Aenean in urna tristique, dictum mauris eget, elementum massa. Suspendisse imperdiet finibus diam, at molestie est venenatis sit amet.

Clients Name

TITLE, COMPANY OR LOCATION GOES HERE